Vaultka JLP Vaults — Initial Backtesting Results and Analysis

Vaultka - Exploring Solana

Vaultka, a leading catalyst in the perpetual DEX space, has been providing users with access to high-quality assets and innovative investment strategies, particularly on the Arbitrum network. With the surging popularity of the Solana ecosystem, many innovative DeFi projects have been launched, including Jupiter, a leading perpetual DEX that boasts a remarkable $20 million in daily trading volume.

Following the successful launch of GM-SOL Leverage and Delta Neutral strategies, to capitalize on the rapid growth of the Jupiter perpetual DEX, Vaultka is proud to announce the debut of its latest offering - the JLP Vault. This new leverage strategy is designed to help users amplify their exposure to the thriving Solana DeFi market by leveraging the JLP token, a diversified position in the Solana DEX ecosystem.

This article proudly presents the outcomes of our extensive simulation and backtesting efforts, providing users with a comprehensive understanding of the expected performance and potential returns of the JLP vault.

Growth of the Perpetual DEX on Solana

The Solana ecosystem has been a hotbed of innovation and growth, particularly within the perpetual DEX market. This sector has experienced a remarkable expansion, characterized by an increase in market size, trading fees, and active traders.

Market size

At the forefront of this burgeoning market are the Drift and Jupiter Protocols, which have established themselves as leading platforms in the derivatives space. Jupiter currently holds the top position, surpassing established decentralized derivatives exchanges like GMX and DYDX. Jupiter's TVL stands at a formidable $664.1 million, signaling strong market confidence and liquidity.

Other Robust Data

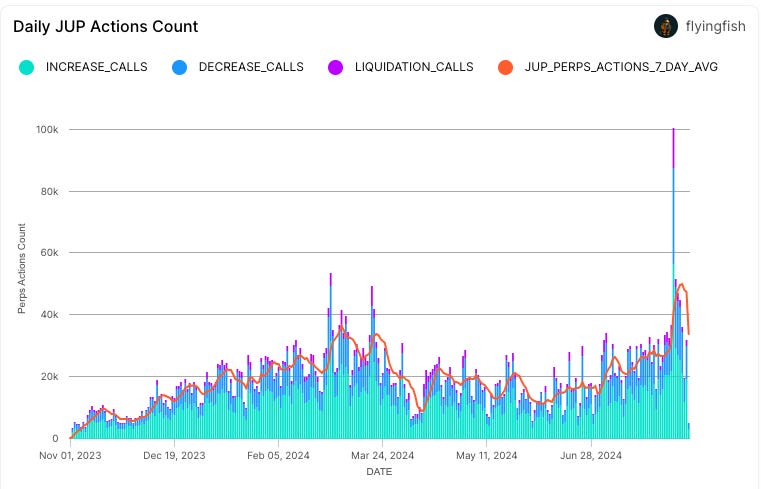

The daily metrics for Jupiter perpetual DEX , such as Daily Perps USD Fees, Unique Wallet Interactions, and Action Counts, have all shown a consistent upward trajectory since November 1, 2023. This uptrend is a testament to the growing user adoption and heightened platform activity. The seven-day moving average offers a clearer perspective on user engagement, smoothing out the daily fluctuations to reveal a sustained positive trend.

Yield Opportunities

Solana's perpetual DEX market is ripe with yield-generating possibilities. Trading fees, borrowing costs, liquidation penalties, and traders' profit-and-loss (PNL) statements contribute to a lucrative environment, with some platforms offering annual percentage yields (APYs) exceeding 100%. These high-yield prospects are designed to attract and retain liquidity providers and traders, fostering a robust and dynamic ecosystem.

To capitalize on this momentum, Vaultka presents a bespoke leverage solution that enables users to amplify their yield potential. By leveraging user funds, Vaultka not only empowers investors to seize the opportunities within Solana's perpetual DEX market but also to harness the ecosystem's ongoing growth.

Diversify Your Crypto Portfolio with JLP

As the crypto market continues to evolve, investors are constantly seeking ways to optimize their portfolios and mitigate risk. In this regard, the JLP token offers a compelling option that combines diversification, consistent returns, and unique revenue-generating potential.

Index Fund of Blue Chip Tokens

JLP is a liquidity provider token for a perpetual DEX and index fund. It has a diversified composition of 44% SOL, 10% ETH, 11% BTC, and 35% stablecoins. This strategic allocation allows JLP to capture the upside potential of some of the top crypto assets while also incorporating stable coins to help stabilize the portfolio.

Profits Share from Protocols

Liquidity providers play a vital role in the perpetual Dexes, acting as counterparties to traders. When traders seek to open leveraged positions, they borrow tokens from the liquidity pool. In return, liquidity providers earn a portion of the fees generated from these leveraged trading activities, as well as borrowing fees and earnings from swaps. JLP token holder receives 75% of the fees generated by the perpetual trading exchange, including

Opening and Closing Fees of Positions (consisting of the flat and variable price impact fee)

Borrowing Fees of Positions

Trading Fees of the Pool, for spot assets

Minting and burning of JLP

All the earning is directly reinvested into the JLP, providing consistent growth of asset.

Feature of Delta Neural

The perpetual DEX has an impressive open interest of $131.3 million, with $115.5 million in long positions and $15.8 million in short positions. By acting as the counterparty to these trader positions, JLP holders can effectively short against traders who are going long.

Since JLP is a diversified basket of assets, including SOL, ETH, WBTC, and stable coins, JLP holders can earn protocol fees while also hedging their exposure to the broader crypto market, creating a low-risk environment that helps maintain steady growth in the price of JLP.

Performance Metrics

From January to July 2024, the JLP token delivered an impressive average monthly return of 9.22%, accompanied by a sharpe ratio of 1.4355 – a clear indication of its favorable risk-adjusted performance . In comparison, individual assets like SOL, ETH, and BTC, while boasting impressive returns, lagged behind in terms of risk-adjusted metrics. SOL returned 12.13% on average but had a lower sharpe ratio of 0.39, while ETH and BTC returned 6.92% and 7.60% on average, with sharp ratios of 0.33 and 0.42, respectively. This mean that you will experience a smaller drawdown if you invested in JLP, suggesting the risk and reward performance of JLP is much better than just holding BTC, ETH and SOL.

Vaultka: Leveraging JLP for Maximum Profit

As a DeFi protocol with positioning as the catalyst of Perp DEX, the launch of JLP’s leveraged products is immenent after conducting back-testings and seeing JLP’s impressive return performance.

Backtest Results

Vaultka’s leveraging strategy is designed to mitigate risk while maximizing potential profits. The results of the backtest are quite compelling. During the period of highest volatility, from April 11th to April 13th, 2024, the JLP token experienced a maximum drawdown of 16.09% - its price dropping from a high of 2.5680 to 2.1548. In contrast, the drawdowns for Ethereum and Solana were significantly higher at 21.18% and 36.02%, respectively.

This data indicates that even with a 5x leverage applied to a JLP position, the user would not have faced liquidation. Instead, they would have been able to capitalize on the superior performance of the JLP token compared to the broader crypto market during periods of heightened volatility.

By delivering superior downside protection while enabling users to amplify their potential profits, Vaultka's leveraging strategy demonstrates a compelling risk-reward profile. This backtest results provide clear evidence of the platform's ability to help investors navigate the dynamic crypto markets and potentially maximize their returns, even in challenging market conditions.

Enhanced Risk-Adjusted Returns with Leverage Strategy

Assuming a risk-free rate of 0.0025 monthly, it was found that the sharpe ratio of JLP increased from 1.4355 to 1.4715 by leveraging to 10x. This indicates that leveraging JLP can enhance risk-adjusted returns, making Vaultka a highly attractive option for investors looking to maximize their profits with JLP.

Why Choose Vaultka: The Superior Leverage Strategy

In the rapidly evolving world of DeFi, Vaultka stands out as a revolutionary platform offering unique advantages over traditional protocols. Here’s why you should consider Vaultka for leveraging your crypto assets:

Cost-Effective Leverage with Reward Split Mechanism

Unlike traditional lending protocols that charge high interest rates, often around 30% , Vaultka's approach is fundamentally different. In traditional protocols, borrowers are required to pay interest on their loans hourly, regardless of whether their trades are profitable or not. This constant interest payment can significantly erode the value of the borrower's collateral and increase the risk of liquidation, especially under leveraged conditions.

In contrast, Vaultka's leverage strategy operates on a Reward Split basis. This means that borrowers only pay a portion of their earnings to the platform, rather than being burdened by fixed, high-interest rates. By aligning the platform's incentives with the borrowers' success, Vaultka creates a more cost-effective and fair environment for users to leverage their positions.

Under the Reward Split model, borrowers can focus on maximizing their profits without the added pressure of hourly interest payments. This structure helps to preserve the value of their collateral and mitigates the risk of liquidation, even in volatile market conditions. The borrower's cost is directly tied to their trading performance, incentivizing them to make prudent decisions and manage their risk effectively.

This innovative approach sets Vaultka apart from traditional lending protocols, offering users a more equitable and sustainable way to leverage their crypto assets. By prioritizing the alignment of interests between the platform and its users, Vaultka's leverage strategy aims to empower investors to potentially achieve greater returns while maintaining a lower-risk profile.

Higher Leverage Potential

Vaultka offers leverage of up to 10 times, significantly higher than the 2 to 5 times leverage typically available in other lending and borrowing protocols or yield protocols. This higher leverage potential can substantially enhance earning capacity for users.

Seamless Integration and User Experience

Vaultka's platform is designed with user-friendly interfaces and intuitive navigation, making it accessible to both experienced DeFi users and newcomers. The platform's seamless integration and user-centric approach help to facilitate a smooth and efficient leveraged trading experience.

Robust Security and Uncompromised Asset Protection

Vaultka's developers have implemented rigorous security measures and undergone extensive audits by Zokyo and Halborn to ensure the platform's resilience against potential threats. By prioritizing the safeguarding of user funds, Vaultka has established itself as a reliable and trustworthy destination for those seeking to leverage their positions without risking the safety of their assets.

Conclusion

Vaultka's tailored leverage strategy positions it as a pivotal player for those looking to maximize their returns in the perpetual DEX market on Solana. With its finger on the pulse of the market's expansion and a deep understanding of yield optimization, Vaultka is your partner in navigating the lucrative landscape of Defi.