Vaultka Lending Pool — Unraveling the Mysterious 25% APR

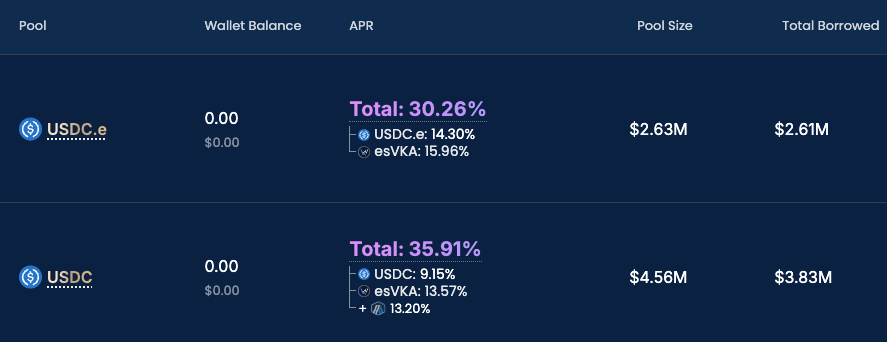

Vaultka's USDC lending pool on Solana stands out as a dual-benefit system, offering borrowers a way to amplify their JLP holdings and providing lenders with a secure avenue to earn a high APR. This article delves into the mechanics behind the potential 25% APR and what makes it a sustainable and compelling option for lenders, providing much higher lending yield to Vaultka’s lenders compared to other traditional lending protocols.

The Core Mechanism

Vaultka's lending pool is integral to a system that allows borrowers to use USDC to leverage their JLP positions. While lenders might not receive interest in the traditional sense, they are entitled to a share of the profits generated by borrowers who engage in the leverage strategy. As our leverage strategies are only available for assets like Perp DEX LP which provides stable and real yield naturally, this innovative profit-sharing model is crafted to mitigate risk and ensure a steady return for lenders.

High Utilization Rate Boost Real Yield

A key indicator of the lending pool's health is its utilization rate. Vaultka's pool consistently maintains high levels, two stable coin pools on Arbitrum that average an 89.6% utilization rate, which is significant because a high utilization rate suggests a strong demand for borrowing. This demand enhance the capital efficiency, contributing to the high APR while maintaining a cushion for lenders to withdraw their funds freely.

High Loan-to-Value (LTV) Ratios

The lending pool's high LTV ratio allows for significant leverage, up to 10 times. This high degree of leverage amplifies the potential returns from JLP positions, thereby increases the profit pool from which lenders can earn.

Aligning Interests with Reward Split Mechanism

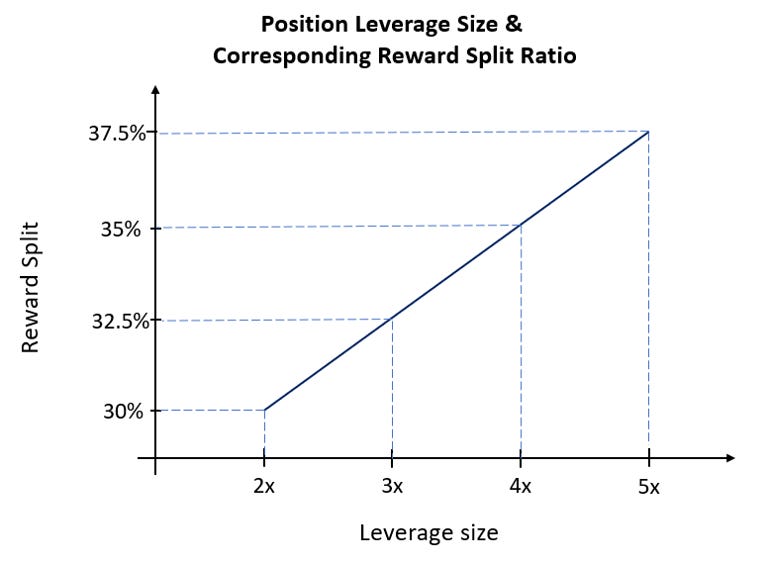

Traditional lending systems often struggle to account for the performance of borrowers, which misaligns the interests of both borrowers and lenders. Lenders' yields are limited by preset interest rates and do not fully capitalize on the borrowers' upside performance, limiting the maximization of lenders' benefits.

Vaultka adopts a reward split mechanism where lenders receive a portion of the profits from leverage strategies. This ratio increases progressively from 30% to 50% as the leverage size grows from 2 times to 10 times. With the average leverage at about 3 times, lenders benefit from 32.5% of the profits, enhancing their effective APR.

Distributing Reward with “Pay-in-advance” Model

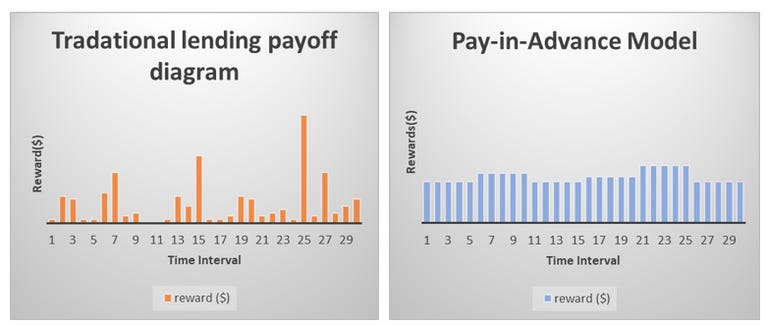

Traditional lending protocols often apply floating interest rates based on the utilization rate of lending pools, such that lenders interests will be subject to the large deposits and withdrawals of borrowers and lenders, causing lenders yield to be uneven and subject to changes.

In contrast, Vaultka's innovative approach addresses this challenge head-on. By adopting a "pay-in-advance" model, Vaultka is able to predict and solidify the upcoming rewards before they actually materialize. This allows the platform to distribute these rewards to lenders on an hourly basis, smoothing out the interest payments and maintaining a stable and sustainable yield, providing lenders with a dependable and stable source of yield., with yields that remain stable and attractive regardless of the underlying asset performance.

JLP Performance: The Revenue Engine

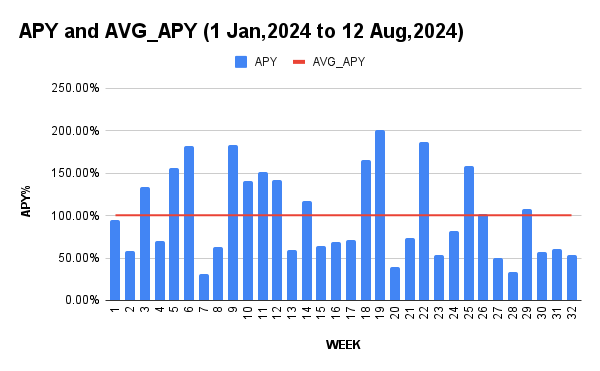

As the profits of the USDC lending pool is determined by the profits which borrower earn form JLP leverage Strategy, the JLP performance play a key role in the whole revenue system for both lenders and borrowers.

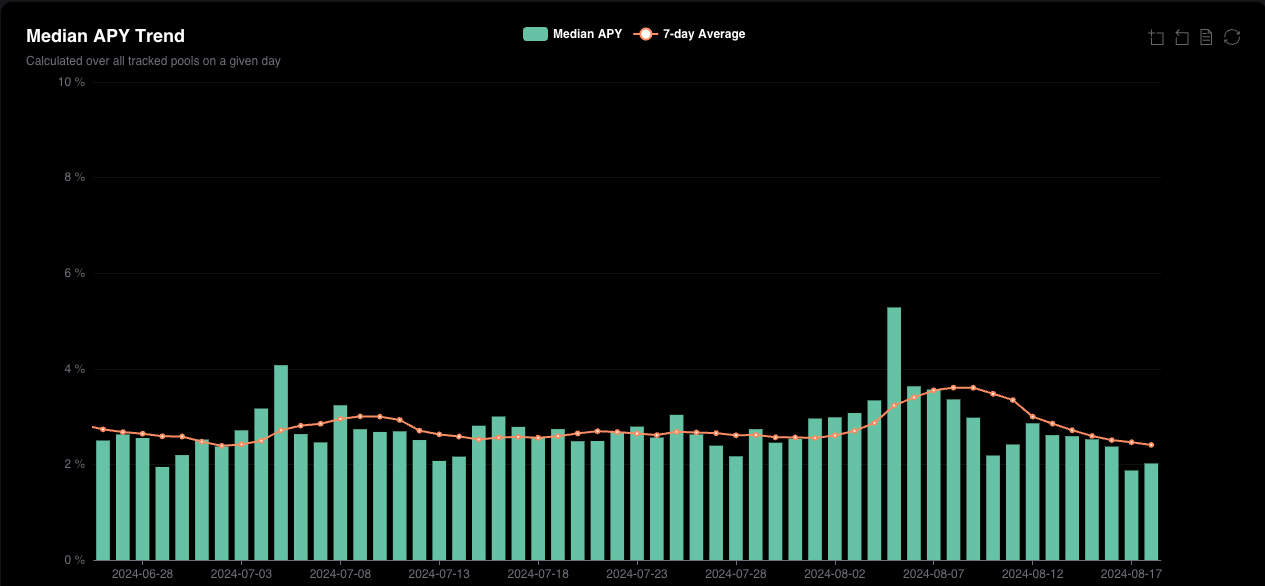

The below graph indicates the JLP token itself has been performing exceptionally well, with a weekly average APR of 100% from January to August in 2024. This impressive yield reflects the success of the underlying strategies and the robustness of the JLP market, which directly benefits the lenders in the USDC pool through the profit-sharing mechanism.

Projecting USDC Lending Pool Performance

Given JLP's strong historical APR performance, we conservatively project a 60% APR for JLP moving forward. Assuming the leverage dynamics on Solana mirror those seen on Arbitrum, with an average leverage ratio of 3x, lenders would receive a 32.5% reward split.

This translates to an expected USDC lending pool performance of 29.25% APR. This comfortably secures the 25% APR promise made to lenders, significantly outperforming the average 3% APR offered by other Solana lending protocols.

The calculation is as follows: Expected USDC Lending Pool APR = JLP APR (60%) * Leverage (3x)/Debt position ratio (3-1) * Reward Split (32.5%) = 29.25%

By providing a significantly higher yield compared to the market average, Vaultka's USDC lending pool offers a compelling value proposition for users seeking to maximize their returns on their capital. This yield advantage positions Vaultka as a leading DeFi lending platform on the Solana ecosystem.

Conclusion

Vaultka's Solana USDC lending pool is a testament to the innovative spirit of DeFi, offering a low-risk investment with the potential for substantial returns. The synergy of a high utilization rate, strategic reward splits, significant leverage capabilities, and the proven track record of JLP's performance coalesce to support the attractive 25% APR. For lenders seeking to capitalize on DeFi's growth while mitigating risk, Vaultka's lending pool presents a compelling opportunity.